Hotel Fraud Training: The Good, The Bad and The Ugly

In the mid-sixties the movie ®The Good, the Bad and the Ugly starring Clint Eastwood was released. The movie is about a bounty hunting expedition to find a fortune in gold buried in a remote cemetery. The movie had some success; however, its title plays on an artful way to describe a set of circumstances.

This can be akin to hotel fraud training: the good, the bad and the ugly. And much like the movie’s theme, a hotel’s employees are vested with maintaining awareness “to find un-fortune-ate fraud buried in possible remote areas of a hotel.”

The Good: Increase in Fraud Training

Recently, the Association of Certified Fraud Examiners (ACFE) released their Fraud Awareness Training: Benchmark Report (the Report). The Report surveyed ACFE member organizations about how they develop, implement, evaluate, and support their fraud training programs. The results of the survey aide organizations about how they can assess its fraud awareness training efforts and determine whether improvements or updates might be necessary.

The good news is the trajectory of fraud training has greatly improved over the years. The Report indicates 71% of responding organizations provide fraud awareness training to its employees. This is a significant achievement!

Fraud training is required for 66% of an organization’s employees and 78% of such training is provided via on-line and/or on-demand training modules. Considering the post-pandemic remote work environment, providing programs via easily accessible venues will greatly assist in achieving a hotel’s required training objectives.

Consider including a pre-set number of hours in each employee’s annual performance plan and then measure their achievement as part of their annual review process. Also, requiring each an employee to pass a post-session quiz will verify their understanding of the course’s objectives.

The Bad: Why Fraud Training is Not Done

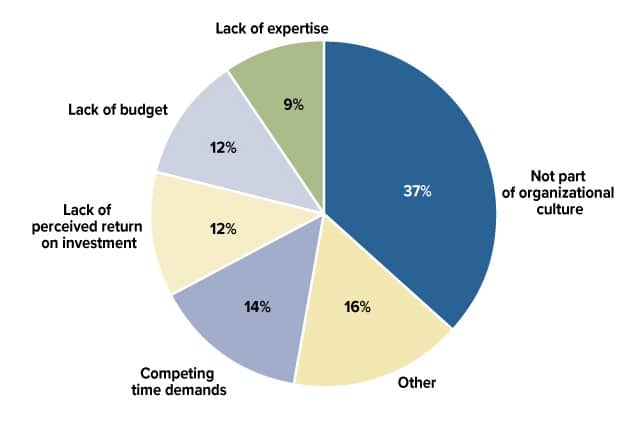

The ACFE report lists the following reasons why fraud training is not conducted:

Credit: ACFE Fraud Awareness Training Benchmarking Report – https://www.acfe.com/training-benchmarking-report.aspx

Sadly, indifferent organizational culture is two to three times higher than the other reasons. This speaks to a lack of “tone at the top” as it relates to fraud awareness.

According to The Ethisphere Institute by those that participate in the Institute’s “The World’s Most Ethical Companies” assessment, find the world’s most ethical companies out-perform a comparable index of large cap companies by 7.1 percentage points from January 2016- January 2021. Granted your hotel is not a large cap company, however it still holds true that a positive and responsive organizational culture is good for business.

It is understood that quantifying the return on investment of fraud training is not an easy thing to calculate. Rarely is the case where an organization can say “we spent $X on training and we identified $Y in fraud. It is a bit science a bit art. An important objective is to minimize the opportunity for fraud; one of the sides of the Fraud Triangle.

The Ugly: Time Devoted to Fraud Training

46% of the organizations surveyed offer annual training and 50% of the annual training is two hours or less. This is an improvement, but more needs to be done.

The question remains, is the training adequate and what is done with the information gained at the training?

In the spirit of full disclosure, training can be mundane! Absent of expanding the hourly requirements, the training must be unique and impactful towards expanding the role of each employee’s awareness.

The ACFE’s 2020 version of its “Report to the Nations” reports 43% of frauds are uncovered via a tip and 50% of those tips are reported by an employee. Not a small number.

Training’s return on investment is partially reflected in these metrics. Your employees are the biggest asset to mitigate the risk of fraud. Leverage that asset with effective training! Effective fraud training must be a continual process, not a once-in-a-while thing. Hopefully, it becomes part of employee’s DNA.

Ethical awareness can be explained like background music in a movie. When the protagonist is faced with a daunting situation, the music takes on a chilling effect. Similarly, effective training can help employees recognize when their ethical background music amps up and to do the right thing.

Make Hotel Fraud Training Fun!

As part of a classroom training, do the following to encourage attendee engagement:

- “$100,000 Fraud Pyramid”, a take-off of the TV version of the “$100,000 Pyramid”. Each one of the clues the contestants (class participants) are given to get their partner to guess the topic are elements of the Fraud Triangle. (Triangle aka Pyramid)

- “Fraud Jeopardy”, again, a take-off of the famous show “Jeopardy”. Each category is a fraud topic, where the contestant is given a fraud related answer and he/she must answer in the form of a question.

Continual Focus on Hotel Fraud Training

Other things to consider around maintaining the stream of fraud awareness:

- Create a short, flashy, one-page newsletter to be periodically circulated that discusses relevant, hot fraud topics. An example is “What Have We Done to Minimize Fraud Due to Covid-19. ” This will help maintain communications and connection with staff.

- Create a fraud trivia contest where the first person to correctly respond wins a small recognition.

- Ask those who represent “the tone of the top” to communicate with staff the need to maintain ethical behavior and support the channels to anonymously report unethical activity.

- Maintain visibility via creating well placed posters that reinforce ethical behavior and how to report instances of deemed inappropriate behavior.

Hotel Red Flags and Team Involvement

The Report goes on to say 91% of fraud training covers hotel red flags, a good thing! The important thing is the red flags covered in the training are relevant to your hotel (and not generic). This may take some work where leadership identifies and inventories the risk of fraud at their particular property.

In the current post-pandemic environment, it is important to assess “the new normal” as it relates to control vulnerabilities. Leverage and collaborate with all your disciplines – human resources, purchasing, finance, information technologies, front office, housekeeping, maintenance, food and beverage and so one. Brain storm where possible exposures exit!

Kevin is a Certified Public Accountant (CPA), Certified Fraud Investigator (CFE), Certified in Financial Forensics (CFF), and maintains a certificate as a Chartered Global Management Accountant (CGMA) who specializes in financial fraud investigations and develops and assesses fraud prevention and internal controls for hotels. Kevin is an inveterate problem solver with over 35 years of hands-on success in tackling and resolving tough issues in audit, compliance and corporate risk management, resulting in recovering millions of dollars of fraud losses. His extensive accounting skills in combination with keen knowledge of financial forensics enables him to effectively execute the most sophisticated investigations. Kevin speaks at various conferences worldwide and has created informative communiques such as “Lessons Learned Series” and “Red Flag Reporter”. Kevin is an active consultant with Cayuga Hospitality Consultants.

Kevin is a Certified Public Accountant (CPA), Certified Fraud Investigator (CFE), Certified in Financial Forensics (CFF), and maintains a certificate as a Chartered Global Management Accountant (CGMA) who specializes in financial fraud investigations and develops and assesses fraud prevention and internal controls for hotels. Kevin is an inveterate problem solver with over 35 years of hands-on success in tackling and resolving tough issues in audit, compliance and corporate risk management, resulting in recovering millions of dollars of fraud losses. His extensive accounting skills in combination with keen knowledge of financial forensics enables him to effectively execute the most sophisticated investigations. Kevin speaks at various conferences worldwide and has created informative communiques such as “Lessons Learned Series” and “Red Flag Reporter”. Kevin is an active consultant with Cayuga Hospitality Consultants.

Contact Us