Bonus Depreciation Fading Away

Bonus Depreciation is fading away over the next 5 years. With the help of the IRS Section 179 Deduction and still powerful Bonus Depreciation, lodging Owners can save thousands of dollars in federal income tax savings in 2022 and beyond.

IRS Section 179 Depreciation

Section 179 of the United States Internal Revenue Code (26 U.S.C. § 179), allows a taxpayer to elect to deduct the cost of certain types of property on their income taxes as an expense, rather than requiring the cost of the property to be capitalized and depreciated. This property is generally limited to tangible, depreciable, personal property which is acquired for the use in trade or business.

For the hotel or lodging owner, tangible property purchased, leased, or financed (new or used) for business use, may be deduct up to $1,080,000 in 2022. There are many tangible assets that qualify for the Section 179 allowance, with the most common lodging assets being:

- Business Vehicles with a gross vehicle weight in excess of 6,000 lbs.

- Computer / Server Equipment

- Guest & Office Furniture & Equipment

- Machinery & Equipment purchased for business use

- Off-the-Shelf Computer Software

- Personal Property used in business

Bonus Depreciation: What Is It?

For tangible property purchases in excess of $1,080,000, not eligible for the Section 179 deduction, the lesser known ‘Bonus Depreciation’; also known as the ‘accelerated first year depreciation deduction’ exists. This tool for accelerating depreciation, over the years, has allowed the lodging owned to effectively expense a percentage (%) of their tangible personal property in the year the property was purchased, leased, or financed. In recent years, that first-year bonus allowance has been 100% in recent years. Meaning, all personal property purchased, leased, or financed for business use can be depreciated (expensed) in the year acquired.

Unfortunately, Bonus Depreciation is slowly fading away, with 2022 being the last year for 100% bonus depreciation, but as we will see below, bonus can still be a powerful tool for expensing tangible personal property that exceeds the section 179 threshold.

Bonus Depreciation History

With a passage of the Tax Cuts and Jobs Act (‘TCJA’) in 2017 by Congress, and signature of the President, 100% Bonus Depreciation (First Year Depreciation) was born. Building off the 2002 Job Creation and Worker Assistant Act, of 30% Bonus Depreciation (First Year Depreciation), the hope was to persuade US businesses to invest in new plants and equipment; to spur the economic growth and job creation.

Bonus Depreciation has had a short life, but has been used multiple times, in the past 20-years to help stimulate the economy and boost job creation. Though there are lesser known, and targeted laws that have affected depreciation, through the use of Bonus Depreciation:

- The Act to Provide for Reconciliation Pursuant to Titles II and V of the Concurrent Resolution

on the Budget for Fiscal Year 2018 - The Gulf Opportunity Zone Tax Relief Act of 2005

- The Tax Extenders and Alternative Minimum Tax Relief Act of 2008.

Additional Acts Having Impact

The more commonly known ‘Acts’ (below) have kept the Economy, and the Workforce moving forward, and it is assumed that 100% bonus depreciation during the height of the COVID Pandemic (2/2020 – 9/2021), did its part to move the sluggish economy forward. Businesses, and Economists, had hoped pre-pandemic, and during the height of the pandemic, that Congress would renew 100% Bonus Depreciation before the planned phaseout starting in 2023.

- Job Creation and Worker Assistance Act of 2002: 30% (First Year Depreciation) of the qualified property placed in service after 9/10/01

- The Jobs and Growth Tax Relief Reconciliation Act of 2003: 50% (First Year Depreciation) of the qualified property placed in service between 5/6/03 and 12/31/04

- The Economic Stimulus Act of 2008: 50% (First Year Depreciation) of the qualified property placed in service between 1/1/08 and 12/31/08

- The American Recovery and Reinvestment Act of 2009: 50% (First Year Depreciation) of the qualified property placed in service between 1/1/09 and 12/31/09

- The Small Business Jobs Act of 2010: 50% (First Year Depreciation) of the qualified property placed in service between 1/1/10 and 1/1/10

- The Tax Relief Act of 2010: 100% (First Year Depreciation) of the qualified property placed in service between 9/9/10 and

12/31/11 and 50% First Year Depreciation) of the qualified property placed in service between 1/1/12 and 12/31/12 - The Tax Relief Act of 2012: 50% (First Year Depreciation) of the qualified property placed in service between 1/1/13 and

12/31/13 - The Tax Relief Act of 2014: 50% (First Year Depreciation) of the qualified property placed in service between 1/1/14 and

12/31/14 - The Protecting Americans from Tax Hikes Act of 2015:

- 50% (First Year Depreciation) of the qualified property placed in service between 1/1/15 and 12/31/17

- 40% (First Year Depreciation) of the qualified property placed in service between 1/1/18 and 12/31/18

- 30% (First Year Depreciation) of the qualified property placed in service between 1/1/19 and

12/31/19

- The Tax Cuts and Jobs Act of 2017:

- 100% (First Year Depreciation) of the qualified property placed in service between 9/28/2017 and 12/31/2022

- 80% (First Year Depreciation) of the qualified property placed in service between 1/1/2023 and 12/31/2023

- 60% (First Year Depreciation) of the qualified property placed in service between 1/1/2024 and 12/31/2024

- 40% (First Year Depreciation) of the qualified property placed in service between 1/1/2025 and 12/31/2025

- 20% (First Year Depreciation) of the qualified property placed in service between 1/1/2026 and 12/31/2026

State of the US Economy

The State of the US Economy has put a halt of any hopes of renewal of 100% Bonus Depreciation. The reason for this shift in sentiment is the “BIG-I” – Inflation! The current inflationary boom (9.1%), coupled with a low US unemployment rate (3.6%) and strong US Gross Domestic Product (5.7%) has Congress, Business, Economists, and the General Public acknowledging that a powerful economic growth and job creation tool, like Bonus Deprecation, is not the proper tool for our inflationary economy.

Strategies for a Fading Bonus Depreciation

Benefit still exists for eligible commercial personal and real property. In the next five years, as bonus is reduced, time can be your enemy.

Bonus Depreciation

2022: 100%

2023: 80%

2024: 60%

2025: 40%

2026: 20%

2027: 0%

- 100% Bonus (First Year Depreciation) is better than 80% Bonus (First Year Depreciation), so try to push your scheduled 2023 Purchases of eligible property into 2022.

- 80% Bonus (First Year Depreciation) is better than 60% Bonus (First Year Depreciation), so try to push your scheduled 2024 Purchases of eligible property into 2023.

- 60% Bonus (First Year Depreciation) is better than 40% Bonus (First Year Depreciation), so try to push your scheduled 2025 Purchases of eligible property into 2024.

- 40% Bonus (First Year Depreciation) is better than 20% Bonus (First Year Depreciation), so try to push your scheduled 2026 Purchases of eligible property into 2025.

- 20% Bonus (First Year Depreciation) is better than 0% Bonus (First Year Depreciation), so try to push your scheduled 2027 Purchases of eligible property into 2026.

Benefit – Net Present Value Tax Savings

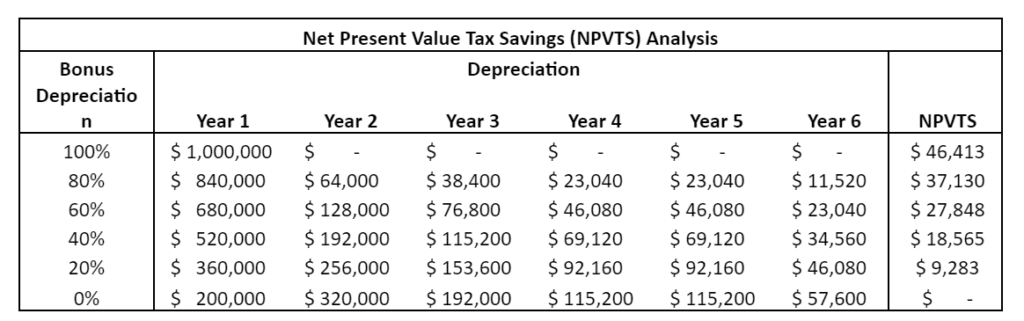

We can demonstrate the effect of declining benefit of reduced Bonus Depreciation (First Year Depreciation) looking at the Net Present Value Tax Saving at each of the Bonus Depreciation Rates (100%, 80%, 60%, 40%, 20% and 0%).

Property Analyzed:

-Product: Lodging Furniture, Fixtures & Equipment

-Purchase Price: $1,000,000

-Federal Income Tax Rate: 33%

-State Income Tax Rate: 6%

-MACRS Depreciation: Mid-Year Convention

-Return on Investment / Discount Rate: 8%

-Tax Depreciation Period: 5-Years

Calculate the Savings

As our graph shows (above), the Net Present Value Tax Savings (NPVTS), if delayed, reduces our NPVTS by $9,283 for each year the acquisition is delayed! Income tax planning, and a targeted purchase date of personal and real property acquisitions, should be coordinated to maximize tax savings

As our graph shows (above), the Net Present Value Tax Savings (NPVTS), if delayed, reduces our NPVTS by $9,283 for each year the acquisition is delayed! Income tax planning, and a targeted purchase date of personal and real property acquisitions, should be coordinated to maximize tax savings

About the author

Walter O’Connell, Managing Director of Hotel Valuation & Cost Segregation Services, LLC (HVCSS) and a consultant at Cayuga Hospitality Consultants. Responsible for a variety of valuation services which include the valuation of tangible assets for purchase price allocation, financing, tax depreciation, insurance, and cost segregation studies. Walt has extensive experience in Furniture, Fixture & Equipment valuation (FF&E) and Cost Segregation Studies within the hospitality industry. Walter holds a Bachelor of Arts degree in Economics and Bachelor of Science degree in Finance from Kean University of New Jersey and a Master of Arts degree in Economics from Montclair State University of New Jersey. Walt continues to strengthen his credentialing by not only taking, but also teaching, technical courses in the fields of Personal Property Valuation and Cost Segregation.

Contact Us